SOCIAL SECURITY RETIREMENT BENEFITS BY YEAR OF BIRTH

CB0002-2020

January 7, 2020

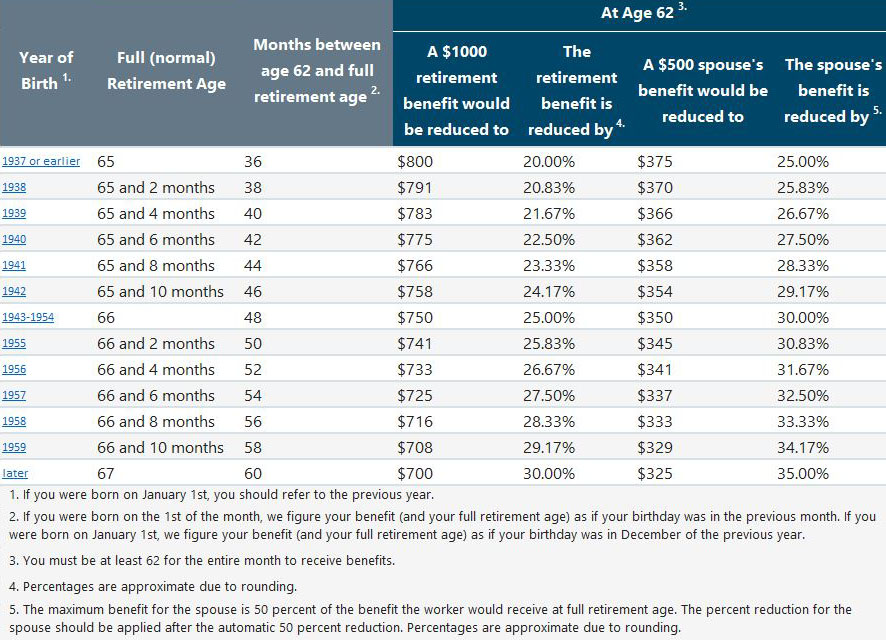

Full retirement age is the age when a person first becomes entitled to full or unreduced retirement benefits. Full retirement age is also referred to as “normal retirement age”.

The beneficiary may receive benefits as early as age 62 or as late as age 70, however benefits will be reduced a fraction of a percent for each month before their full retirement age. Note that if the beneficiary delays full retirement age, they may be entitled to delayed retirement credits that would increase their monthly benefits.

1. If they were born on January 1st, they should refer to the previous year.

2. If they were born on the 1st of the month, we figure their benefit (and their full retirement age) as if their birthday was in the previous month. If they were born on January 1st, we figure their benefit (and their full retirement age) as if their birthday was in December of the previous year.

3. They must be at least 62 for the entire month to receive benefits.

4. Percentages are approximate due to rounding.

5. The maximum benefit for the spouse is 50 percent of the benefit the worker would receive at full retirement age. The percent reduction for the spouse should be applied after the automatic 50 percent reduction. Percentages are approximate due to rounding.

The chart below lists age 62 reduction amounts and includes examples based on an estimated monthly benefit of $1000 at full retirement age.

As always, we thank you for your support and cooperation. For questions or comments, please email us at Compliance@NSGACommunications.com or you may call the toll-free number listed below.

FOR AGENT USE ONLY. NOT FOR USE WITH CONSUMERS.

Compliance Updates | 2650 McCormick Drive | Clearwater, FL 33759 | 844.206.2927